take home pay calculator manitoba

The minimum annual wage in Manitoba be interpreted with caution was calculated by taking an average of 36. You assume the risks associated with using this calculator.

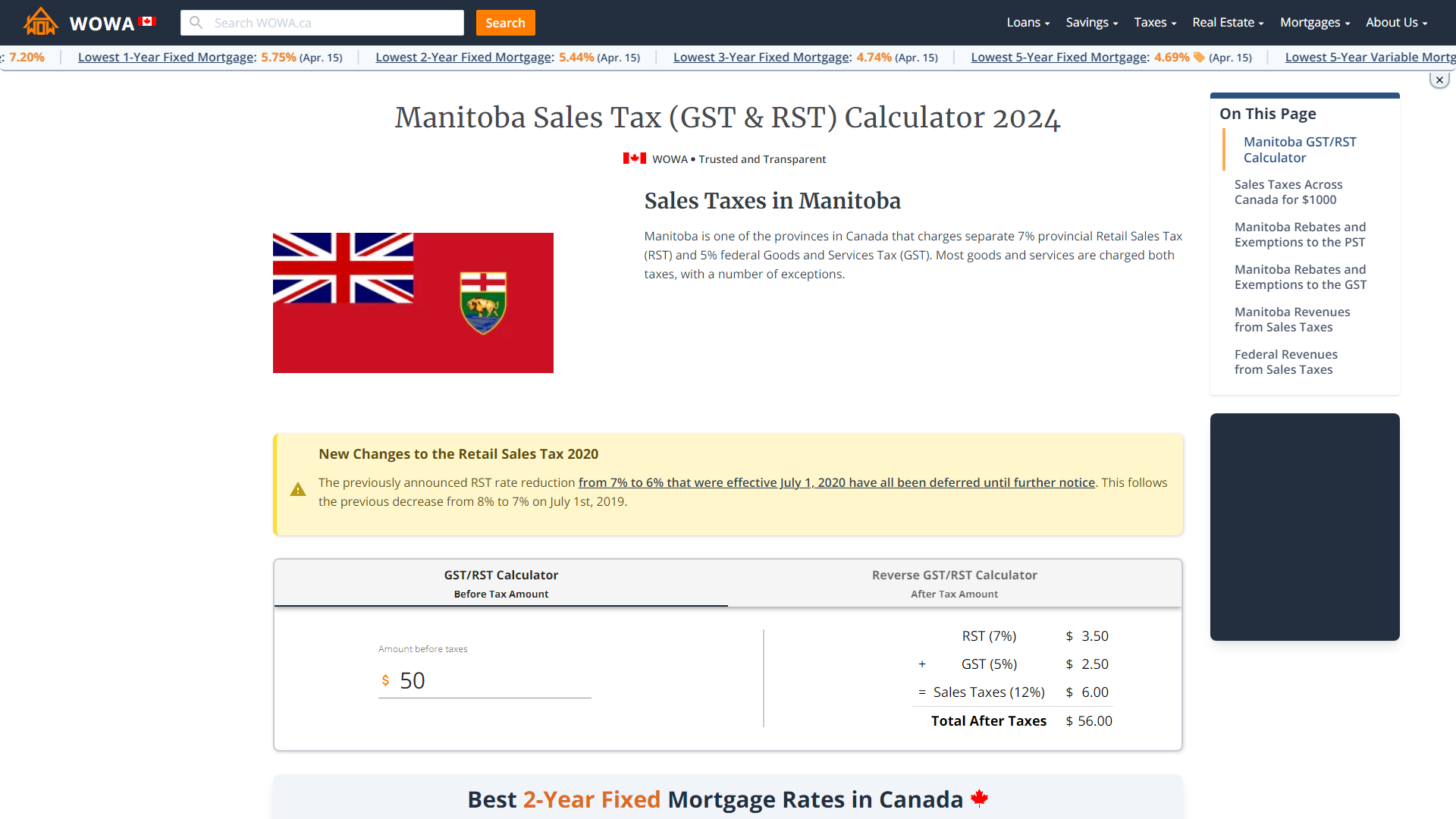

Manitoba Gst Calculator Gstcalculator Ca

Manitoba NB Manitoba Saskatchewan NS.

. With Advanced payroll well even take care of the filings. No change to the minimum has been made since october 1st 2015. The reliability of the calculations produced depends on the.

Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. British Columbia Alberta Saskatchewan Manitoba Ontario New Brunswick Nova Scotia Prince Edward Island Newfoundland Yukon Northwest Territories Nunavut. Take Home Pay Calculator by Walter Harder Associates.

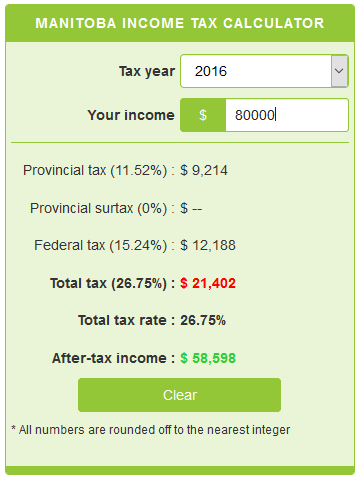

Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon. To calculate your yearly taxable income multiply your monthly salary by 12 and. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

Annual salary average hours per week hourly rate 52 weeks minus weeks of vacation - weeks of holidays For example imagine someone earns 15 per hour in Manitoba works an average of 35 hours per week and has a total of 4 weeks of vacation and holidays. The formula for calculating your annual salary is simple. Amounts above 45142 up to 90287 are taxed at 915.

The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Your average tax rate is 314 and your marginal tax rate is 384.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you. A quick and efficient way to compare salaries in Canada in 2022 review income tax deductions for income in Canada and estimate your 2022 tax returns for your Salary in Canada.

Personal Income Tax Calculator - 2020 Select Province. The Manitoba Income Tax Salary Calculator is updated 202223 tax year. Enter your pay rate.

Instead of entering that info every time you write a pay cheque you can enter it once and run payroll in a couple clicks with QuickBooks Online plus Payroll. It is perfect for small business especially those new to payroll processing. Enter the number of hours worked a week.

Well calculate the pay and taxes each pay run and keep you ready for year end. The Canada Tax Calculator is a diverse tool and we. Theres an easier way.

This marginal tax rate means that your immediate additional income will be taxed at this rate. That means that your net pay will be 40568 per year or 3381 per month. Were making it easier for you to process your payroll and give your employees a great experience with their payslips.

It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by US. Youll then get your estimated take home pay a detailed breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to expect when planning your budget.

Here is a picture of the minimum wage at the general rate in Manitoba from 1965 to 2022. Single SpouseEligible dep Spouse 1 Child Spouse 2 Children Spouse 3 Children. To start complete the easy-to-follow form below.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. Your average tax rate is 220 and your marginal tax rate is 353. Enter your salary into the calculator above to find out how taxes in Manitoba Canada affect your income.

It will confirm the deductions you include on your official statement of earnings. Personal Income Tax Calculator - 2021 Select Province. You can use the calculator to compare your salaries between 2017 and 2022.

The minimum weekly wage was calculated by taking an average of 368 hours per week. This marginal tax rate means that your immediate additional income will be taxed at this rate. Please indicate which one of the following roles applies.

Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program. That means that your net pay will be 35668 per year or 2972 per month. The amount can be hourly daily weekly monthly or even annual earnings.

Here is a step-by-step guide to calculating your province net income in Manitoba. ADP Canadian Payroll Tax. The calculator is updated with the tax rates of all Canadian provinces and territories.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Income Tax Calculator Manitoba 2021. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany.

Enter your pay rate. The payroll calculator from ADP is easy-to-use and FREE. If you make 52000 a year living in the region of Manitoba Canada you will be taxed 16332.

Calculate your take home pay in 2022 thats your 2022 salary after tax with the Canada Salary Calculator. Rent Assist helps Manitobans pay an affordable rent which has been set at 80 of Median Market Rent according to household size. Determine taxable income by deducting any pre-tax contributions to benefits Your taxable income is your entire salary including wages tips bonuses and income from other sources that you received in one tax year.

Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location. About the 2022 Manitoba Salary Calculator. Welcome to the Severance Pay Calculator.

Anonymous accurate FREE way to quickly calculate the termination pay severance package required for an Ontario BC Alberta employee let go from a job. Use this simple powerful tool whether your employees are paid salary or hourly and for every province or territory in Canada. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Enter your salary into the calculator above to find out how taxes in Manitoba Canada affect your income. Rent Assist is a monthly shelter-related financial benefit to help low-income Manitobans who pay rent in the private market and who are required to spend a large portion of their income on rent.

Manitoba Income Tax Calculator Calculatorscanada Ca

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Manitoba Real Estate Commission Calculator Wowa Ca

Birth Chart Calculator Birth Chart Chart Natal Charts

2021 2022 Income Tax Calculator Canada Wowa Ca

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

![]()

Manitoba Income Tax Calculator For 2022

Small Town Vibes With Big City Size Charleswood Winnipeg Manitoba Realtor Ca Blog Suburbs Small Towns Neighborhood Guide

Avanti Gross Salary Calculator

Manitoba Spousal Support Calculator

Manitoba Income Tax Calculator Wowa Ca

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

Manitoba Property Tax Rates Calculator Wowa Ca

Manitoba Salary After Tax Calculator World Salaries