food tax calculator pa

A calculator to quickly and easily determine the tip sales tax and other details for a bill. Designed for mobile and desktop clients.

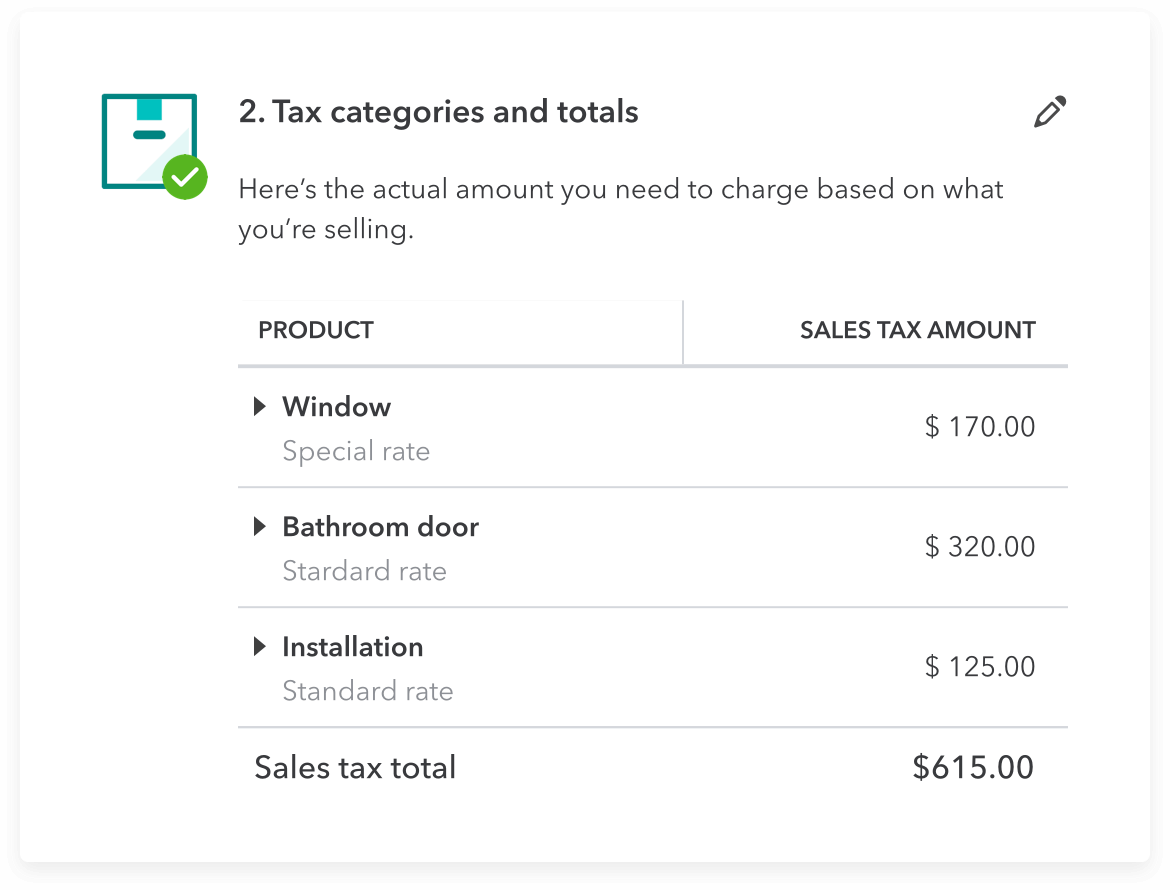

Learn How Quickbooks Online Calculates Sales Tax

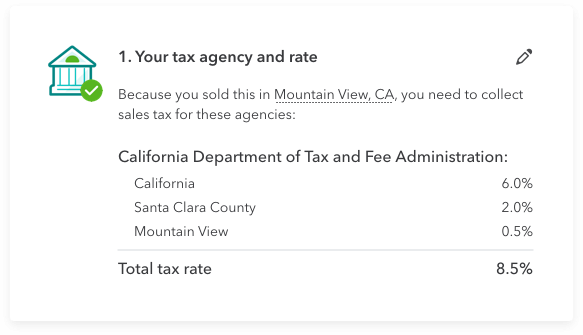

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. This is the connection between a seller and the state. This Monthly Federal Tax Withholding Calculator is intended to be used as a tool to estimate your own federal tax withholding.

The distribution of liquor is a state enterprise under the auspices of the Pennsylvania Liquor Control Board LCB. Net Price is the tag price or list price before any sales taxes are applied. Pennsylvania also levies local income taxes in more than 2500 municipalities.

Total Price is the final amount paid including sales tax. There is a 25 tax on food in general but in certain counties and cities restaurants can charge up to 65 on top of this depending on where its located. For State Use and Local Taxes use State and Local Sales Tax Calculator.

The Pennsylvania PA state sales tax rate is currently 6. The Pennsylvania Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Pennsylvania State Income Tax Rates and Thresholds in 2022. Details of the personal income tax rates used in the 2022 Pennsylvania State Calculator are published below.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Pennsylvania residents only. Food trucks must collect sales tax on the point of sales. Understanding California S Sales Tax Is Food Taxable In Pennsylvania Taxjar Llc Tax Calculator Definitive Small Business Tax Estimator Freetaxusa Federal State Income Tax Calculator Estimate Your Irs.

Pennsylvania Salary Paycheck Calculator. All liquors sold by the LCB are subject to this 18 percent tax which is calculated on the price paid by the consumer including mark-up handling charge and federal tax. It is not meant to constitute a representation binding on.

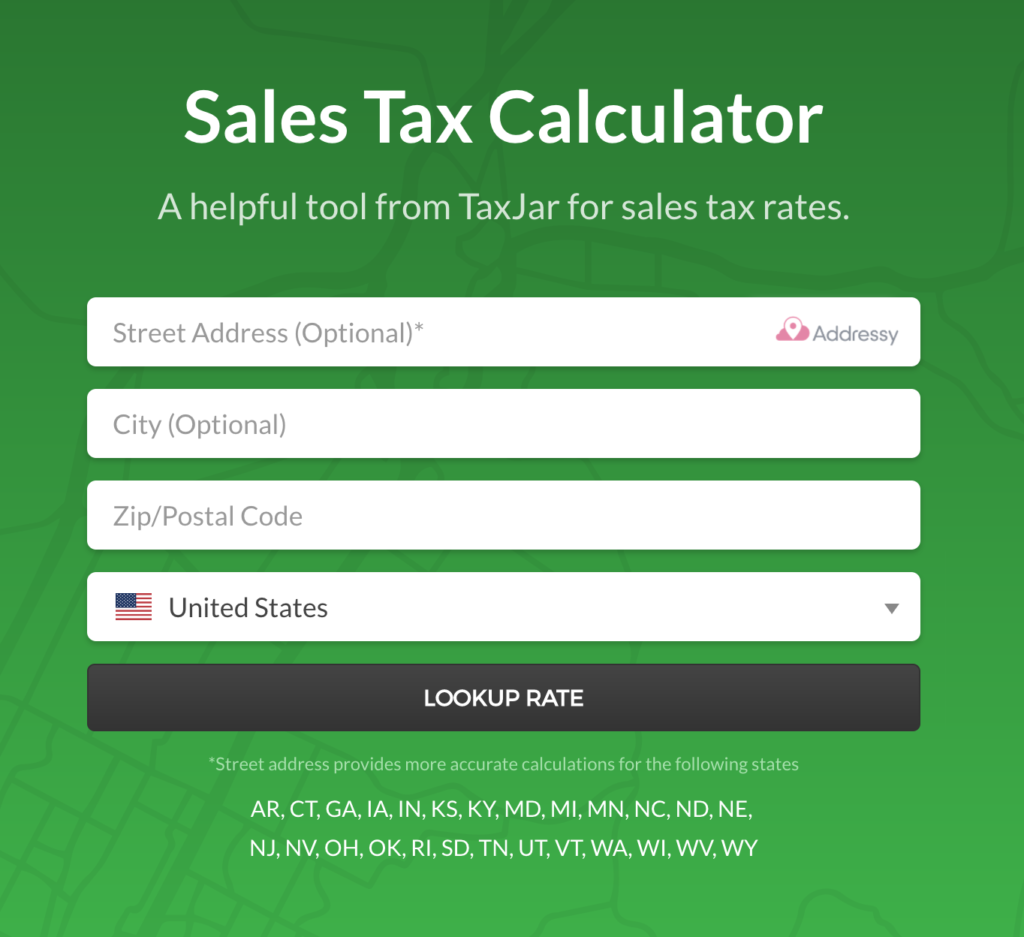

Switch to Pennsylvania hourly calculator. Created with Highcharts 607. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Pennsylvania local counties cities and special taxation districts.

Consequently Chicago restaurants within the McPier Tax zone administer an 1125 percent sales tax while those outside the zone administer a 1025 percent sales tax. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 8. Percent of income to taxes 32.

It is not a substitute for the advice of an accountant or other tax professional. Sales Tax 932. Food tax calculator pa Thursday February 17 2022 Edit.

Use this app to split bills when dining with friends or to verify costs of an individual purchase. Just like federal income taxes your employer will withhold money to cover this state income tax. For more information on the food and beverage tax you may call our business tax information line at 317 232-2240.

Virginia Restaurant Tax. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. As of Tuesday the four biggest food-delivery apps were charging sales tax on food but industry leader DoorDash which also owns Caviar and Postmates were not collecting the tax on service and delivery fees.

Your household income location filing status and number of. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Pennsylvania has a 6 statewide sales tax rate but also has 69 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0122 on.

Depending on local municipalities the total tax rate can be as high as 8. The Indiana Department of Revenue DOR provides the food and beverage tax rates for each county or municipality in the table below. All data presented on this page is subject to audit verification and recomputation and is provided as a convenience to you.

Pennsylvania is one of just eight states that has a flat income tax rate and of those states it has the lowest rate. To use our Pennsylvania Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. In another scenario a sales tax for any restaurant can include food stands and cafeterias but in some states universities are exempt from imposing sales tax.

Pennsylvania is one of the few states with a single statewide sales tax which businesses are required to file and remit electronically. If a food truck in Louisiana sells taxable products they need to collect a sales tax of 952. For example if a food truck in Washington sells taxable products the vendor needs to collect a 921 sales tax from their customers.

While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. As of January 1st 2020 the average tax of prepared foods in Virginia is 5. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634.

Even on the food Postmates was charging just a 6 sales tax in Philadelphia not the required 8. Find out more on Virginias Tax Website. Once youve gathered your information to determine eligibility use an online calculator see Resources to help you determine your monthly food stamp benefit in Pennsylvania and once you have determined eligibility you can also apply for benefits directly through the link in the Resources section.

Calculate your Pennsylvania net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Pennsylvania paycheck calculator. After a few seconds you will be provided with a full breakdown of the tax you are paying. There are a few factors that contribute to higher SNAP allowances and income limits in Pennsylvania.

Total Estimated Tax Burden 18072. Sales Tax Amount Net Price x Sales Tax Percentage 100 Total Price Net Price Sales Tax Amount. Factors include household size monthly income and if a member of your household is 60 years old or older or has a disability.

This page describes the taxability of food and meals in Pennsylvania including catering and grocery food. You may also contact your county auditors office to learn if your county has this tax. Use an online food stamp calculator.

To learn more see a full list of taxable and tax-exempt items in Pennsylvania. Last updated November 27 2020.

How Do State And Local Sales Taxes Work Tax Policy Center

How To Charge Your Customers The Correct Sales Tax Rates

Learn How Quickbooks Online Calculates Sales Tax

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

How Do State And Local Sales Taxes Work Tax Policy Center

How To Calculate Sales Tax Video Lesson Transcript Study Com

Sales Tax On Grocery Items Taxjar

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

How To Charge Your Customers The Correct Sales Tax Rates

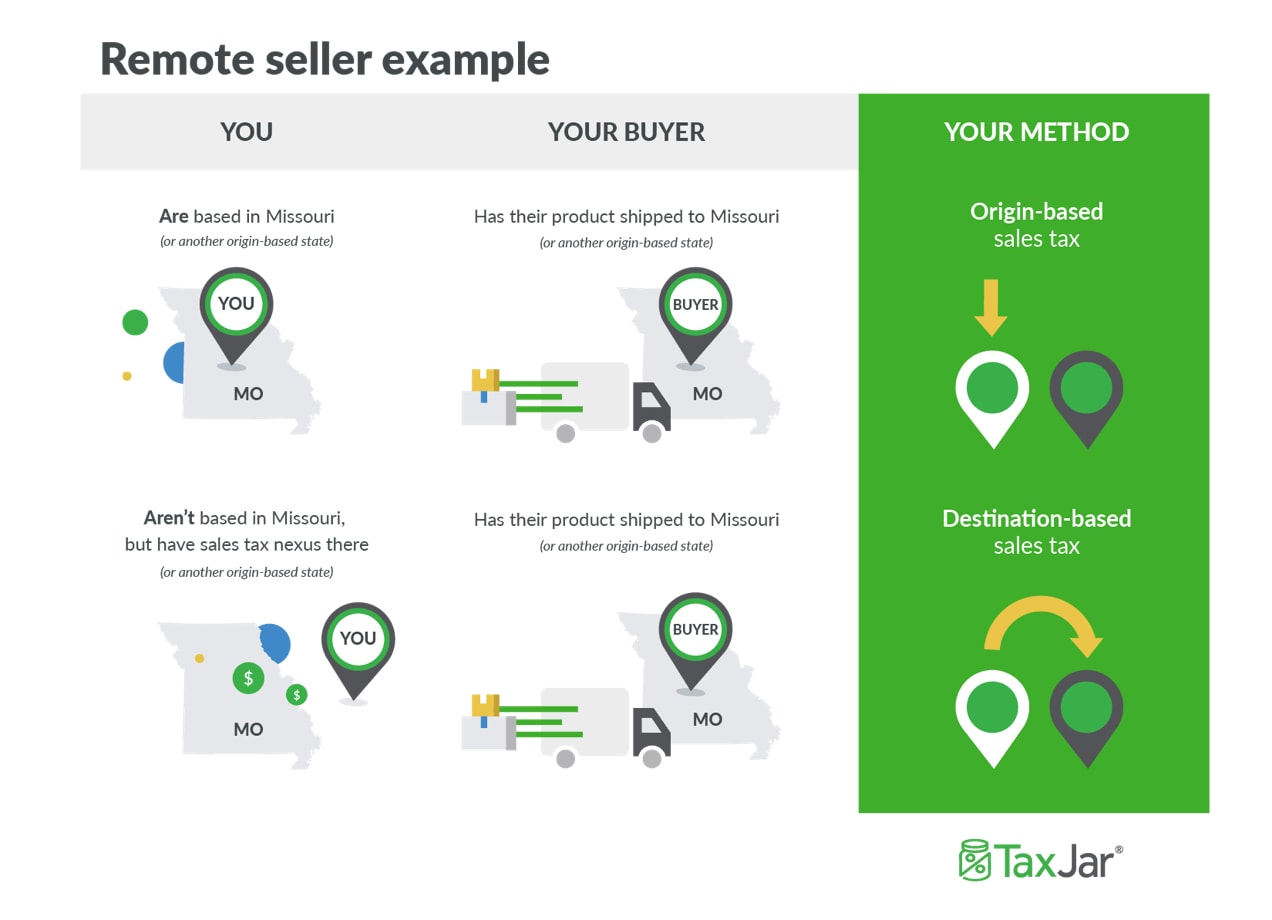

What Is Sales Tax Nexus Learn All About Nexus

How To Charge Your Customers The Correct Sales Tax Rates

Understanding California S Sales Tax

Pennsylvania Sales Tax Small Business Guide Truic

What Canadian Businesses Need To Know About U S Sales Tax Madan Ca

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

States With Highest And Lowest Sales Tax Rates

Alaska Income Tax Calculator Smartasset

How To Calculate Sales Tax In Excel Tutorial Youtube

Woocommerce Sales Tax In The Us How To Automate Calculations